Fresh revelations about Nigeria’s state oil company have reignited public outrage, as calls for a sweeping audit of the Nigerian National Petroleum Company Limited (NNPCL) intensify. The storm follows a World Bank report exposing a N500 billion shortfall in remittances for late 2024—funds that should have gone into the national coffers.

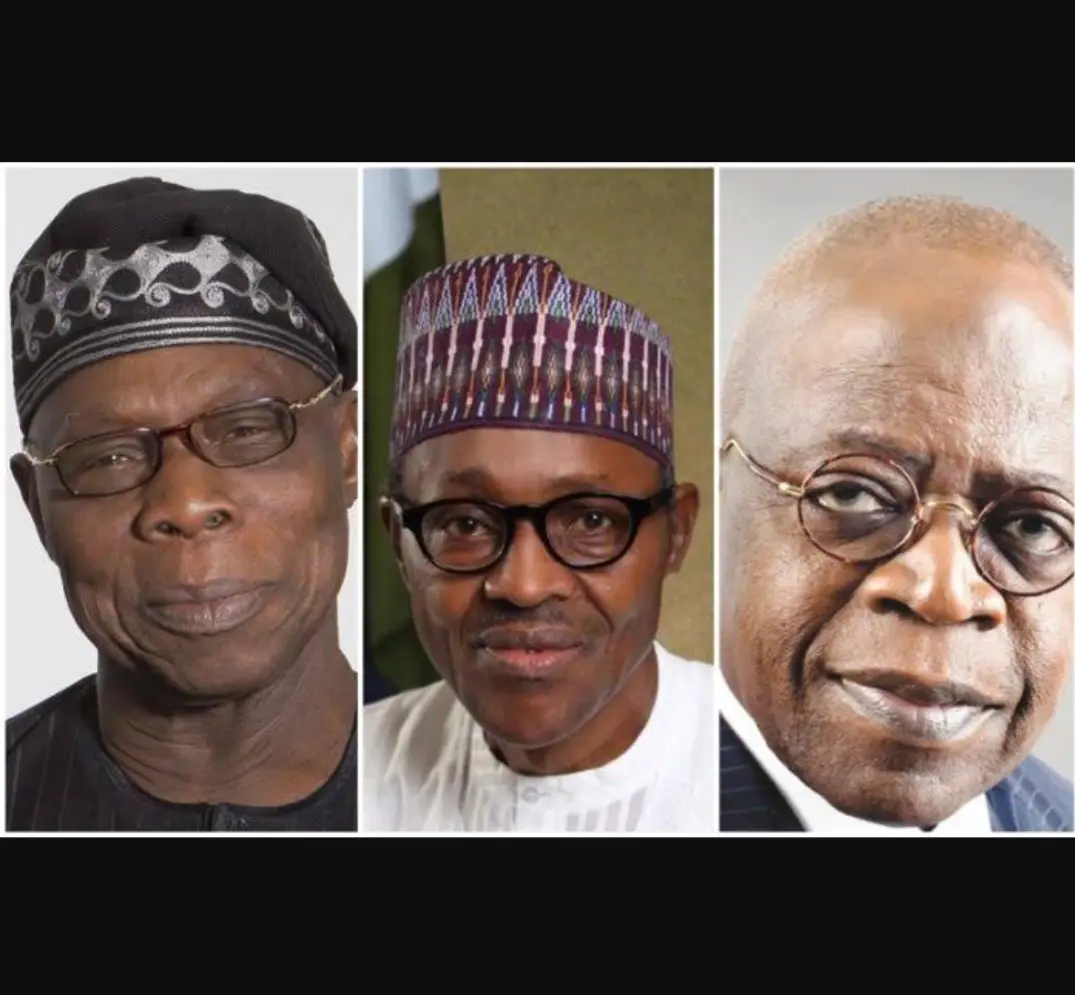

Transparency International Nigeria (TI-Nigeria) has pointed fingers at the country’s last three presidents; Bola Tinubu, Muhammadu Buhari, and Olusegun Obasanjo, for allegedly enabling a long-standing culture of financial secrecy and corruption in the NNPCL.

Auwal Rafsanjani, the country director of TI-Nigeria, described the oil giant as a “black hole” of unaccounted funds during an interview with DAILY POST. He insisted that the financial rot predates current leadership and can only be addressed by a full audit covering all administrations since 1999.

According to the World Bank’s latest Nigeria Development Update, the NNPCL reported N1.1 trillion in revenue from crude oil and other sources for 2024, but only N600 billion was transferred to the Federation Account. The remaining N500 billion has vanished into what critics say is a widening hole of mismanagement and lack of accountability.

But this is not new. The International Monetary Fund had earlier raised similar red flags, urging Nigeria to improve transparency in handling subsidy savings and oil proceeds. Over the years, watchdog groups like the Socio-Economic Rights and Accountability Project (SERAP) have repeatedly demanded answers, with little success.

Much of the controversy is tied to the dual roles many presidents have played as both heads of state and self-appointed petroleum ministers. Rafsanjani says this power concentration has weakened independent oversight and fostered unchecked executive control over the oil sector.

“For decades, the NNPCL has operated without real scrutiny. Every president who appointed himself petroleum minister only deepened the secrecy. We need to break that cycle,” Rafsanjani said.

He also criticized the National Assembly, accusing lawmakers of failing to carry out their oversight duties. “The silence and inaction from parliament has made them complicit,” he added.

Backing these concerns is Barrister Ameh Madaki, an energy sector expert and managing partner at BBH Consulting. He said the recent N500 billion gap is just a glimpse into a much deeper problem.

“What happened to the $3.3 billion NNPCL borrowed to stabilize the naira using crude futures? The naira still crashed. No one has accounted for that money,” Madaki said. He noted that during Buhari’s second term, the NNPCL stopped remitting funds altogether, claiming it had transformed into a private company and would only pay out audited profits.

According to Madaki, such tactics have allowed the company to dodge responsibility under the guise of corporate restructuring.